Credit Card Competition Act: Myths & Facts

Most of what the credit card industry, banks and their surrogates have said about the Credit Card Competition Act is misleading, and much of it simply isn’t true. Here are the facts about some of the key issues regarding this bipartisan, bicameral, pro-consumer legislation that is quickly gaining support in Congress.

Most of what the credit card industry, banks and their surrogates have said about the Credit Card Competition Act is misleading, and much of it simply isn’t true. Here are the facts about some of the key issues regarding this bipartisan, bicameral, pro-consumer legislation that is quickly gaining support in Congress.

Will credit card rewards be affected? No

The bill addresses which network transactions are routed over for processing, and that has nothing to do with rewards. Rewards are determined by banks, not networks, and are used as a marketing tool to convince consumers to choose a Visa or Mastercard card from one bank rather than another bank. Nothing about that will change.

Furthermore, the $16.4 billion in projected savings is less than 10 percent of swipe fee revenues, so banks would still have plenty of profits to pay for rewards. Many merchants offer rewards of their own through loyalty programs and manage to do so even with an average profit margin of under 3 percent. By comparison, the money center banks that issue the vast majority of credit cards have an average profit margin of 27 percent.

A study by payments consulting firm CMSPI says rewards would be reduced by less than one-tenth of 1 percent “at most” and that banks have “more than sufficient margin” to offset lost swipe fee revenue and “maintain current reward levels.”

Finally, rewards have not gone away in other countries where swipe fee reform has been adopted. A decade after reform in Australia, the Reserve Bank of Australia found banks still offered “significant credit card rewards” despite Visa and Mastercard claims that rewards would go away. In fact, Australian banks even lowered interest rates, a move that benefits the average consumer far more than rewards points.

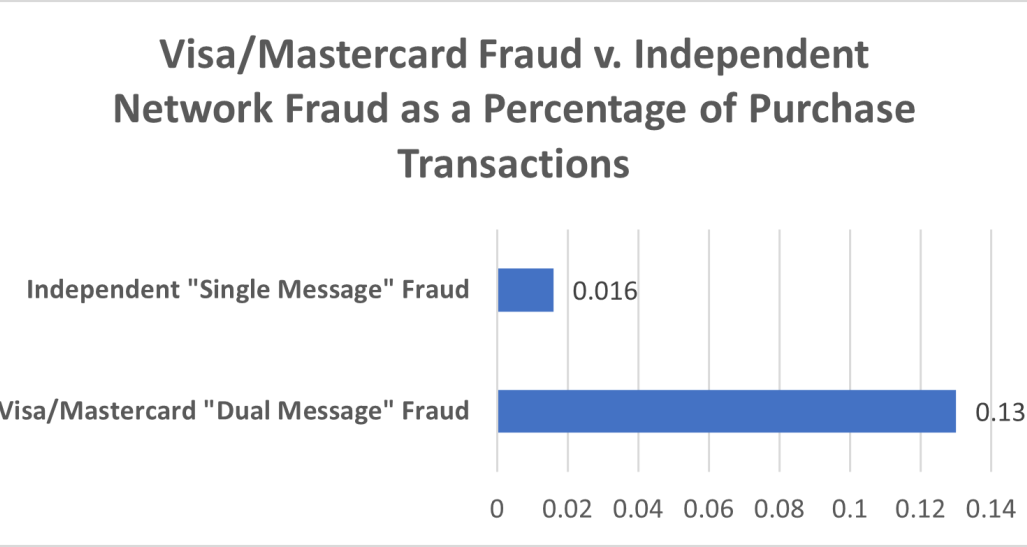

Will credit card security be harmed? No

The bill requires that credit cards be able to be routed over at least two unaffiliated networks. One could still be Visa or Mastercard while the second could be networks like NYCE, Star or Shazam. Those networks are currently trusted by banks and consumers alike with billions of dollars in debit card and ATM transactions each day. In fact, the Federal Reserve says they have about one-eighth the fraud of Visa and Mastercard’s networks. American Express and Discover, both of which have robust security, could also be the second network.

In addition, the legislation would close a glaring security gap by blocking networks supported by foreign governments like China’s UnionPay from entering the U.S. processing market. Currently, any bank could choose to route its credit card processing to UnionPay, effectively outsourcing consumers’ sensitive financial data to a foreign government.

Competition also leads to innovation in security. It was only after debit card swipe fee reform, for example, that networks began the introduction of end-to-end encryption of data and accelerated the adoption of EMV chip cards in the United States.

Source: Federal Reserve 2021 Interchange Fee Revenue, Page 36, Table 10

Will community banks and credit unions be affected? No

The carefully targeted legislation applies only to financial institutions with at least $100 billion in assets. According to the Federal Reserve, there are only 32 banks in the entire country that are that large. That list includes American Express and Discover’s banks, which do not issue Visa or Mastercard cards and therefore aren’t affected. And Morgan Stanley and Capital One are counted twice, leaving an actual total of 28 affected banks. Only one credit union – Navy Federal – meets the $100 billion threshold. Not a single community bank or small credit union would be affected.

Will merchants share savings with consumers? Yes

After similar routing competition for debit card transactions took effect in 2011, a landmark study by acclaimed economist Robert Shapiro found 70 percent of the estimated $8 billion a year in savings was passed on to consumers. The latest estimate from payments consulting firm CMSPI shows the savings at $9 billion a year. At this point, over $100 billion has been saved and proportionately shared.

Correspondingly, Moody’s Investor Services reported that the savings from debit reform has shielded consumers from higher prices that would have resulted from increases in other operating costs. Consumer prices rose only half as much as wholesale prices in the first five years after debit reform, clearly showing that merchants protected customers from increases they faced. And a Federal Reserve study conducted after reform found three-quarters of merchants surveyed had been able to avoid raising prices for their customers altogether despite constant increases in wholesale costs. Merchants are highly competitive and profit margins have remained narrow – generally under 3 percent and even lower in some sectors – while bank and credit card profit margins have continued to rise – an average 27 percent for large banks, 45 percent for Mastercard and 50 percent for Visa in 2022.

CMSPI estimates that at least $16 billion a year will be saved with credit card routing, with the savings expected to be once again shared with consumers.

Will cards have to be reissued? No

Routing is a back-office procedure in which banks share information regarding enabled networks with processors. It does not require the change of anything physical on the cards. When debit routing was debated, banks claimed they would need to reissue cards, but they did not when the routing was actually implemented. Over time, some credit cards – Diner’s Club, for example – have used more than one network with no re-issuance required. Even if banks chose to replace cards, credit cards are routinely reissued every two or three years as they reach their expiration dates, so the change could be phased in as part of that cycle.

Would consumer choice be affected? No

Consumers can currently choose among a wide variety of Visa or Mastercard credit cards issued by banks across the country, each offering different interest rates, rewards, cash-back options, logos of universities and sports teams and other benefits. Nothing about that will change. By contrast, neither merchants nor consumers have any choice in which networks credit card transactions are routed over today. This legislation would allow merchants to choose the networks that offer the best security, service and fees for the benefit of their customers, bringing choice to how credit card transactions are routed rather than reducing choice.

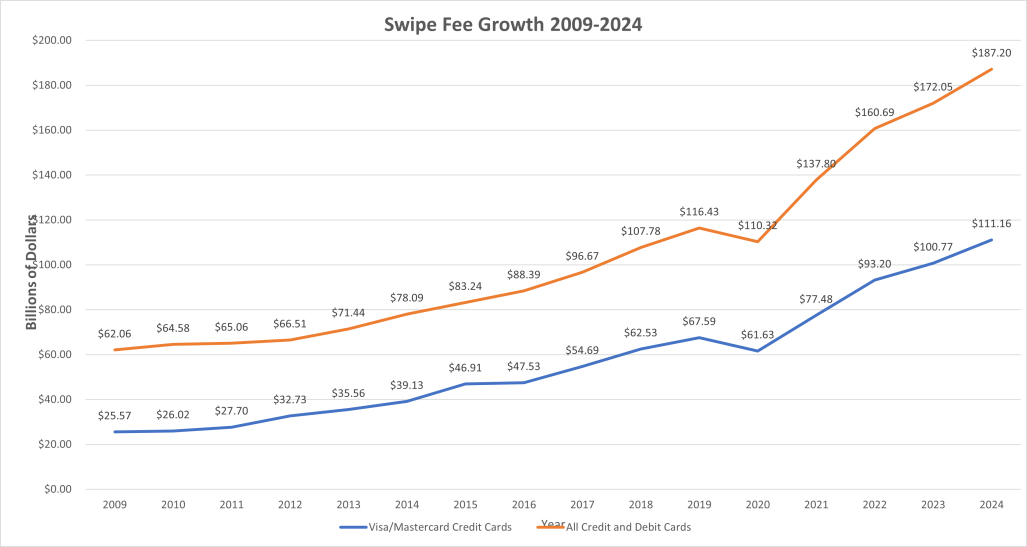

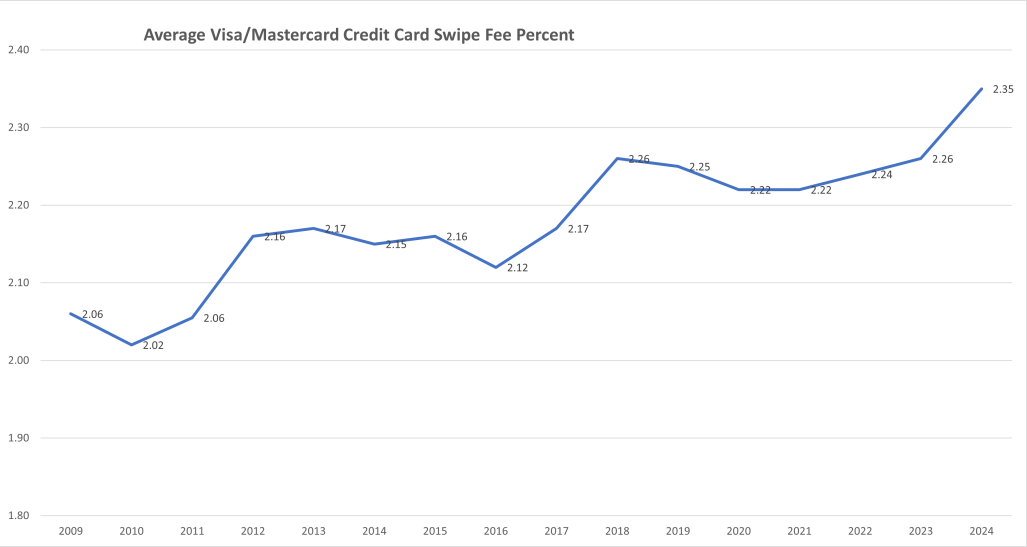

Have swipe fees increased? Yes

The card industry claims credit card swipe fees have been stable over the past decade. In fact, the average rate for Visa and Mastercard credit cards has risen from 2 percent of the transaction amount in 2010 to 2.35 percent in 2024. That increase has had a massive effect when multiplied against trillions of dollars in transactions each year. And while that is the average, far more credit cards today are premium rewards cards, which carry a swipe fee of 3 percent or even 4 percent. The number to look at is total swipe fees for credit and debit cards, which reached a record $187.2 billion in 2024 and have more than doubled in the past decade, rising 70 percent since the pandemic alone. Visa and Mastercard credit card swipe fees made up the bulk of the total at $111.2 billion – nearly triple the amount a decade earlier. Without competition, swipe fees continue to go nowhere but up.

Source: Nilson Report

Source: Nilson Report

Would Free Checking Go Away? No

Banks claim the number of checking accounts without a monthly fee dropped after debit card swipe fee reform was passed by Congress. But the 11 percent drop they cite is from 2009 to 2010 – a period before debit reform took effect – and was actually prompted by the financial crisis of 2007-2008. Debit reform didn’t take effect until October 2011. And, according to the American Bankers Association, 61 percent of banks offered free checking in 2014 – up from 50 percent of banks in 2010. Free checking actually increased after debit reform.